News

Automotive Storage Products Already in Mass Production, Providing New Growth Momentum for Longsys's Future Development

2022.05.19

With the in-depth application of AIoT, big data, cloud computing, and other new-generation information technologies in various fields, global data volumes have soared in recent years. This has significantly driven the demand for storage products.

According to an IDC study, the volume of the Global DataSphere will increase from 32 ZB in 2018 to 175 ZB in 2025. The Global DataSphere represents the collection of data created, captured, replicated, and consumed each year. The volume of data generated in China will also increase from 7.6 ZB in 2018 to 48.6 ZB in 2025, making it the largest DataSphere in the world.

With data volumes skyrocketing, there is an urgent need for organizations to tidy and store massive volumes of data. This has further boosted the demand for storage products. Recently, a reporter from the "Into the Industry Chain" column of Xin Ba Ge (a media platform of Huaqiang Electronic Network Group focusing on the semiconductor industry) interviewed the sales leader of Longsys's SDG Division. The sales leader pointed out that the demand for data storage products is continuously rising in the current digital economy. As a major manufacturer of memory and storage solutions in China, Longsys has seen a continued increase in sales and prices of its flagship products. The market share of Longsys's eMMC products ranks among the top globally (data from the ChinaFlashMarket Report 2020). In the future, the acceleration of Chinese products replacing non-Chinese products will be quicker. Longsys is expected to have significant room for growth.

1. Sales and prices of embedded storage products have risen, and their market share is one of the largest globally.

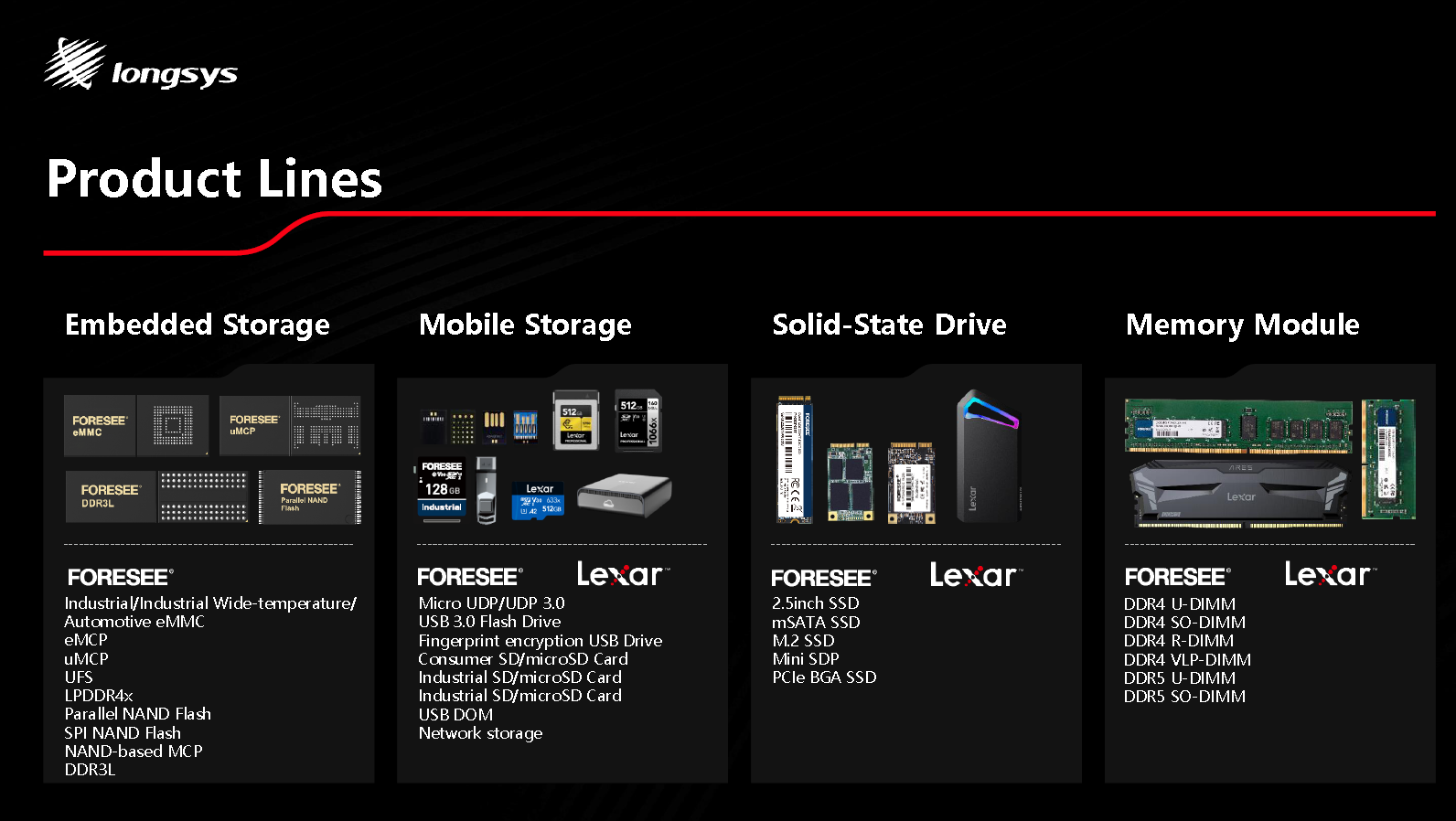

According to public information, Longsys specializes in the R&D, design, and sales of Flash and DRAM storage products. By focusing on storage products and applications, Longsys has now established four product lines: embedded storage, solid-state drive (SSD), mobile storage, and memory module. These products are widely used in various fields, such as intelligent terminals, Internet of Things, security surveillance, industrial control, automotive electronics, and personal mobile storage.

Longsys's four product lines

Source: Longsys

Longsys has achieved rapid development in recent years, with all businesses continuing to expand. According to the 2020 eMMC embedded storage market share ranking released by ChinaFlashMarket (CFM), Longsys's eMMC products had a 4% market share, ranking seventh worldwide. Additionally, Omdia (IHS Markit) data shows that Lexar ranked second in the global market share of memory cards and third in the global market share of flash drives (USB drives) between January and September 2021.

According to Longsys's prospectus, Longsys's embedded storage products are its flagship products, accounting for nearly 50% of its primary business revenue. According to different applications, embedded storage products can be divided into embedded multimedia cards (eMMC) and universal flash storage (UFS). They are primarily used to meet storage needs in consumer electronics, industrial control, and smart vehicle applications. The eMMC, in particular, has a large volume and extensive application in the embedded storage market and has a presence in each submarket.

The sales leader of the SDG Division explained to the reporter that

in 2019, Longsys's industrial eMMCs were already mass-produced for the power sector, which also shows that Longsys has the ability to provide integrated solutions to the power market. Longsys will further expand its submarkets in the power sector, such as converged gateways for power, concentrators, relay protection, and power distribution modules, to provide constant "new blood" for the company's development.

UFS is a new-generation technology with larger bandwidth and faster response speeds than eMMCs. It is primarily used in terminal devices with high capacity requirements, such as high-end cell phones, tablet PCs, VR devices, and smart cars. Longsys's commercial UFS are now mass produced. Its automotive UFS is scheduled for launch in the second half of 2022.

With product innovations and excellent quality control, Longsys's embedded storage products have been welcomed warmly by the market and customers. According to the data published in Longsys's prospectus, both the sales and prices of Longsys's embedded storage products have grown. Sales increased from RMB 2,402,818,700 in 2019 to RMB 4,780,746,000 in 2021, nearly doubling in two years.

In terms of specific sales and unit prices, 17,172,200, 198,080,000, and 211,260,900 embedded storage products were sold between 2019 and 2021, respectively, at a CAGR of 10.92%. Their unit prices during this period were RMB13.99, RMB16.56, and RMB22.63, respectively, with a CAGR of 27.18%. The above data shows that Longsys's embedded storage products have achieved significant sales and price growth.

2. The strategic dual brand-driven development targeting business and consumers respectively enables Longsys to serve customers across all areas more comprehensively.

Longsys is now focusing primarily on two brands, one is the industry storage brand - FORESEE, and the other is the international premium consumer storage brand - Lexar.

FORESEE and Lexar target different types of customers. FORESEE mainly serves industry and business customers, while Lexar primarily serves consumers. FORESEE and Lexar are committed to their respective market, which allows Longsys to provide more comprehensive and better services to customers across various fields.

Using the experience gained during Longsys's years of technology and product development in the storage field, FORESEE will launch its automotive eMMC (Grade2) and automotive UFS (Grade2) products this year.

Both brands are growing at a fast pace, he said, with many iconic product launches having taken place in their respective business areas. FORESEE, for example, has already launched its PCIe Gen3*4 XP1000 and Gen4*4 XP2100 on the market and sold them in large quantities. Their downstream customers are mainly industry customers with higher performance requirements. In addition to mainstream products, FORESEE can also provide customized products such as M.2 2230 and BGA SSDs for customers with special requirements.

Source: Longsys website

Lexar is an international premium consumer storage brand with a 26-year history. Lexar products have an excellent reputation and a loyal user base in photography, audio and video, and high-end mobile storage applications (such as outdoor sports equipment). Lexar memory cards have a strong market presence in China, North America, Europe, Asia Pacific, and other markets around the world.

3. Automotive storage products have been mass-produced, providing new growth momentum for Longsys's future development.

As vehicles become more intelligent, they are gradually transforming from transportation tools to mobile terminals. This has brought new market opportunities to the storage industry.

According to Gartner, global NAND flash storage consumption in the advanced driver-assistance system (ADAS) sector reached 220 million GB in 2019. Although the growth rate of this consumption will slow down, it is expected to remain strong in the coming years. Global NAND flash storage consumption in the ADAS sector is expected to reach 4.15 billion GB by 2024. This consumption will experience a compound growth rate of 79.9% between 2019 and 2024.

Longsys is one of the first manufacturers in China to deploy automotive storage products. With years of technological development and accumulated experience, Longsys has built a full-fledged chip development platform. All aspects of Longsys's production process comply with IATF16949 certification standards. Automotive storage chips of various capacities and categories have passed the AEC-Q100 Grade2/3 certification.

Longsys's automotive eMMCs have already been mass-produced in 2021. Longsys is also one of the few companies in China that can mass produce automotive eMMCs.These products perform well in harsh environments with high environmental tolerance and resistance to temperature changes, static electricity and electromagnetic interference. With high reliability and long durability, Longsys's storage devices can operate 24/7 for long periods of time in complex environments.

Additionally, Longsys can customize products to meet its customers' needs by leveraging the extensive experience it has accumulated over the years. A wide range of customization options are available for automotive storage products, including but not limited to chip appearance, software partitioning, pSLC, and encryption. By offering point-to-point customization, Longsys can provide customers with the supply advantages of easy application, a short production cycle, and cost control.

Source: Longsys website

It is worth emphasizing that Longsys has begun to reap the benefits of its continued investment in automotive storage products. Longsys now has many forms of automotive storage products such as NAND Flash, eMMC, UFS, and DDR3L. These products have been recognized by most leading brands. Longsys will deepen its collaboration with factory-installed and tier 1 customers in the future to meet their multi-dimensional storage capacity needs.

Longsys has expanded significantly in recent years, achieving a rapid growth in both revenue and net profit. When talking about the reasons for Longsys's earnings growth, he analyzed that the external reason is the growing storage demand in the current digital economy. Longsys has made preparations in industrial layout and personnel planning as well as resource allocation to make company operations more appropriate and efficient. The internal reason is that Longsys has implemented the "Start a New Business" program with equity incentives for employees, which aims to enable more staff who are involved in the company's operations to work together as company owners to drive the company's development.

It is well known in the industry that China is the largest producer and consumer of electronic devices, and also the largest end-user of memory chips. However, memory chips manufactured in China currently account for only a tiny fraction of the market share. There is tremendous room for growth in China's storage industry. Longsys, as one of the major memory and storage solution providers in China, is expected to gain significant growth opportunities.

(Source: https://www.hqew.com/, published on May 19, 2022)

Previous Longysy Deeds as A Participant in Digital Trade Fair EmbeddedWorld2022 2022.06.15

Next Interview with Longsys: Application Trends in Different Storage Markets 2022.01.13

we give our all

Phone:+86-13510641627

WeChat:Longsys_electronics

E-mail:marcom@longsys.com